The Big Kiss Off

Once upon a time, in the not so distant past, American workers and the big Corporations they helped build held a loving if not symbiotic relationship. The worker gave hours of his/her life to further the betterment of The Corporation and thus increase profits for the stockholders. In return, the worker received a good wage, health insurance benefits and a pension to help aid his/her retirement. Now, I don't know how you view it, but when a company offers a pension plan to attract talent which further generates profit for said company, then the company in question has entered into a contractual agreement with the employee to supply the agreed upon pension. After all, word is bond. Or is it? Apparently not. By law, The Corporation does not have to offer it's workers a pension plan in the first place, so it isn't obligated to fulfill pension promises. I wish the same line of thinking worked with credit cards. I could open up as many accounts as possible, max them out, and then refuse to pay them. After all, the credit card companies sent ME their invitation, advertisements, junk mail, ect. I didn't ask for the solicitation.

Once upon a time, in the not so distant past, American workers and the big Corporations they helped build held a loving if not symbiotic relationship. The worker gave hours of his/her life to further the betterment of The Corporation and thus increase profits for the stockholders. In return, the worker received a good wage, health insurance benefits and a pension to help aid his/her retirement. Now, I don't know how you view it, but when a company offers a pension plan to attract talent which further generates profit for said company, then the company in question has entered into a contractual agreement with the employee to supply the agreed upon pension. After all, word is bond. Or is it? Apparently not. By law, The Corporation does not have to offer it's workers a pension plan in the first place, so it isn't obligated to fulfill pension promises. I wish the same line of thinking worked with credit cards. I could open up as many accounts as possible, max them out, and then refuse to pay them. After all, the credit card companies sent ME their invitation, advertisements, junk mail, ect. I didn't ask for the solicitation.It is disheartening, but not at all surprising, that horribly mismanaged giants like GM and United Airlines are moving to freeze or eliminate pension plans for lifelong employees. But as reported by the AARP, more and more profitable companies are also working to either freeze or eliminate pension plans as well.

The move to freeze pensions at solid, profitable companies like Verizon—and at others, including IBM, Sprint, Nextel, Tribune Corp., Lexmark, Alcoa and Russell Corp.—is the latest sign of pressure on traditional guaranteed pension plans. "It's an entirely new phenomenon for healthy companies to freeze their pensions," says Alicia Munnell, director of the Center for Retirement Research at Boston College.

To add insult to financial injury, our leaders in Washington have taken it upon themselves to writlegislationon that HELPS The Corporation with it's Indian Giving scheme.

Legislation now moving through Congress may also have the effect of encouraging companies to freeze defined benefit pensions. Some of the measures are intended to make sure companies adequately fund their pensions. But in general, the legislation could give less protection to workers and more to the Pension Benefit Guaranty Corp. (PBGC), the federal agency that insures pensions and pays benefits when companies can't meet their obligations.

In the proposed legislation, companies with underfunded plans would be required to fully fund pensions sooner—within seven years—and pay higher premiums to the PBGC (the Senate bill would give struggling airlines 20 years). Under the House plan, a company would be forbidden from paying out lump sums if the funding for its pension plan fell below 80 percent. And under both bills, if funding fell below certain levels, benefit accruals would cease.

So where does that leave those who have built their whole lives working towards a retirement, only to have their pension reduced or eliminated? They have a limited amount of time to invest in a 401K. Their Social Security income may or may not be funded at the time of their retirement (depending on who in Washington you talk to). My advice would be to rob a bank and buy an island off of the coast of Dubai.

What's sad is some of these workers don't make enough to be able to make up the difference in a 401K, the whole pension plan being promoted as a benefit rather than a larger wage. Then the increasing elimination or reduction of health care benefits to retirees cuts into their already limited income. You have elderly who thought they were going to have a comfortable retirement who end up in low paying hourly jobs just to make ends meet. This will create an increased demand on entitlement programs which are already being cut. Yet some of these company executives still get their golden parachutes.

ReplyDeleteYeah, I was sad to hear about the dissolution of IBM's last defined-benefit plan, and now we hear about GM doing away with theirs.

ReplyDeleteDefined-benefit was very good to my grandparents, though my father, as an educator, was at the vanguard of the 401K movement.

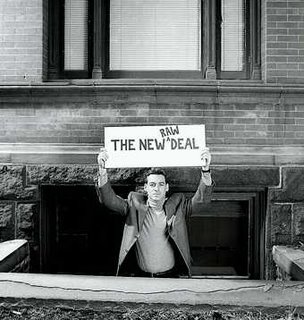

Yeah, we're getting the raw deal alright. I have no idea what my retirement is going to be like. I think the best plan is to have rental property...

ReplyDeletegreat post..I always feel like I am a little smarter after I come here...hmm, buy an island ? maybe...

ReplyDeleteWhere some see cold, calculated moves by Corporate America, I see a major boon for faith-based initiatives!

ReplyDeleteI mean, imagine all the opportunities in the coming years for soup kitchens and homeless shelters!

As a compassionate conservative Christian, I give thanks to GM (and Jesus, of course.)

I just saw the blog before this. Drew.. you are too good just to quit.

ReplyDeleteTake a break, recharge the jets, come back swinging.